- Uniswap: Revolutionizing Decentralized Finance (DeFi)

In the ever-evolving world of blockchain and cryptocurrency, Uniswap has emerged as a groundbreaking decentralized exchange (DEX) that has redefined how users trade digital assets. Since its launch in 2018, Uniswap has become one of the most prominent platforms in the decentralized finance (DeFi) ecosystem, enabling users to swap tokens, provide liquidity, and participate in a trustless, permissionless financial system. This article explores the origins of Uniswap, its underlying technology, its impact on the DeFi space, and its future potential.

What is Uniswap?

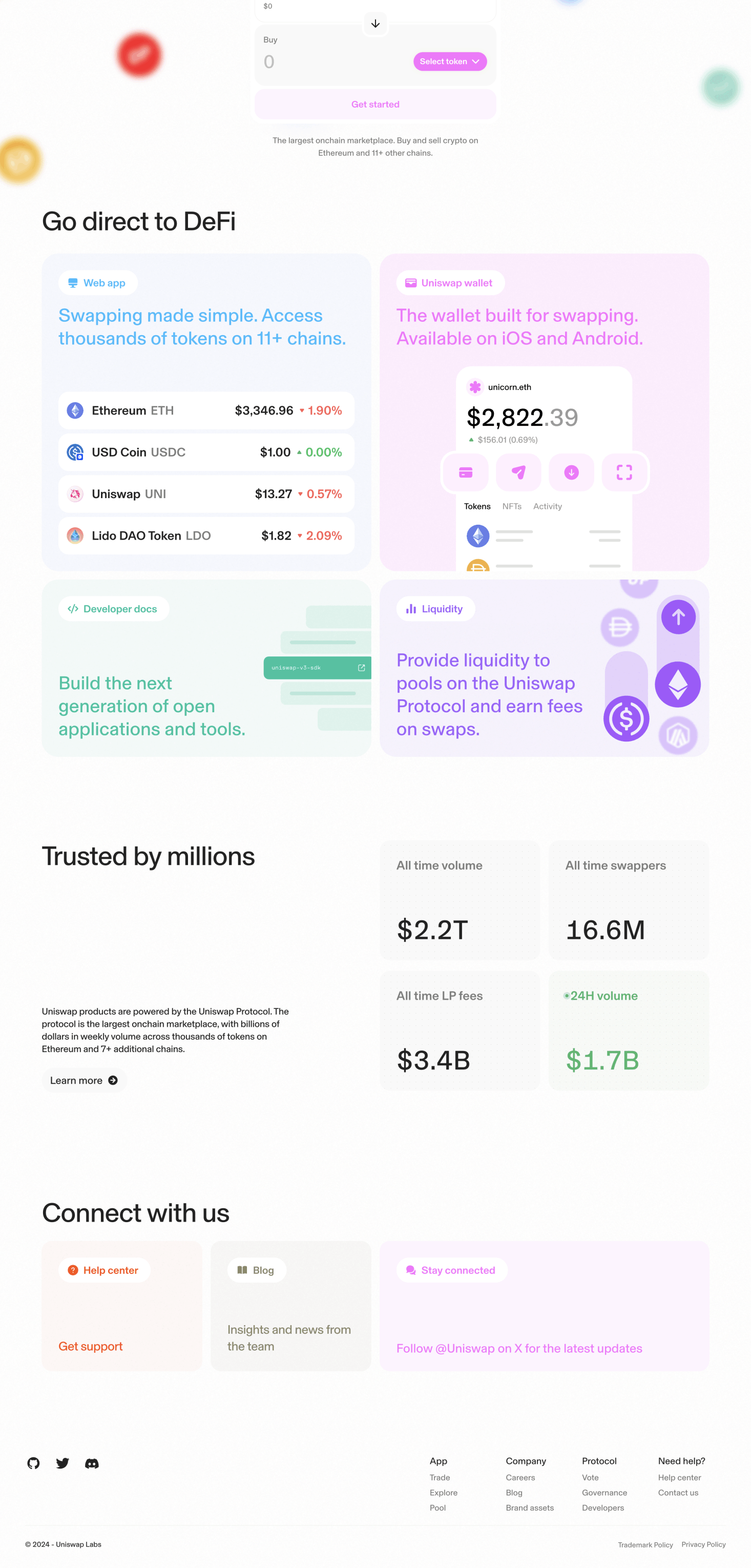

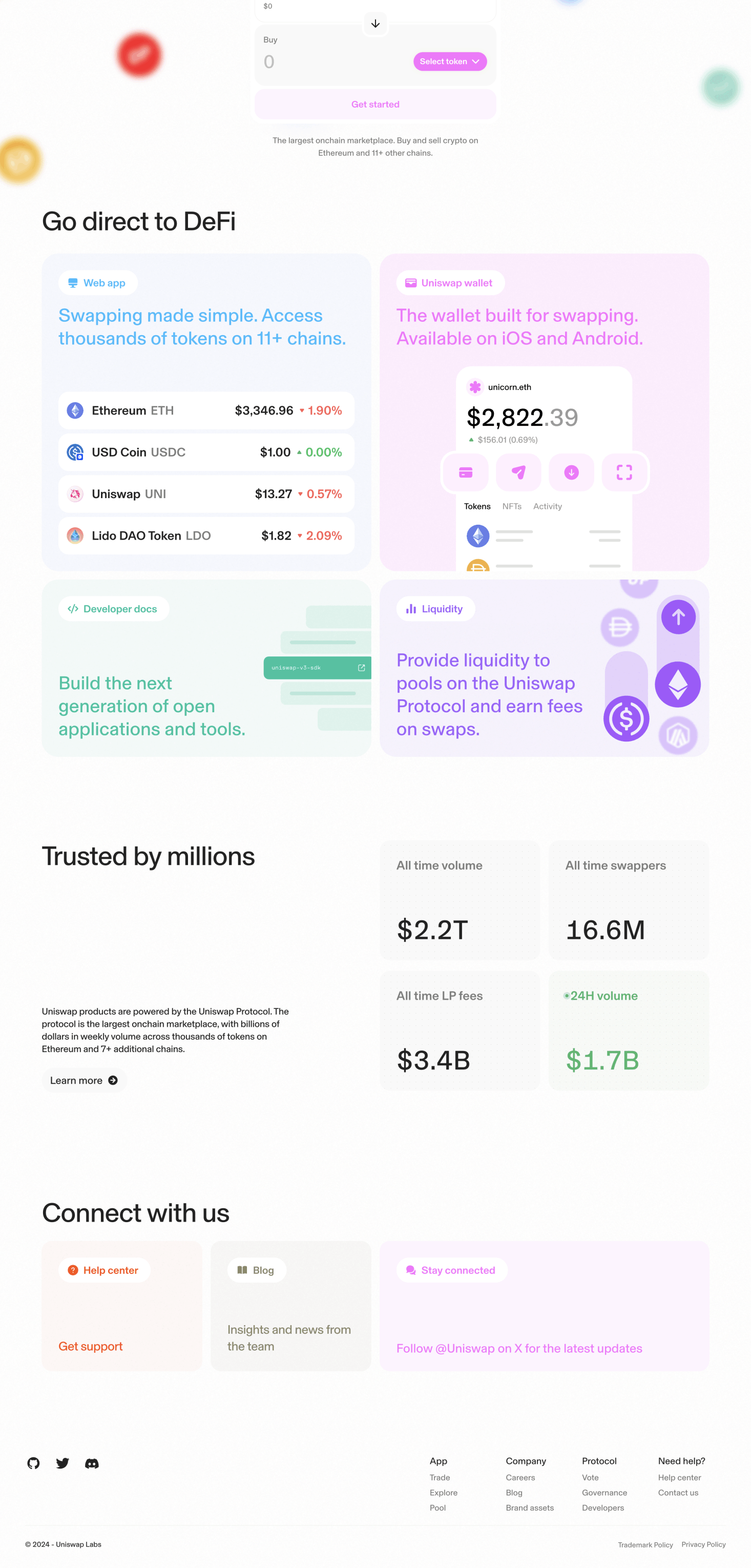

Uniswap is a decentralized exchange built on the Ethereum blockchain. Unlike traditional centralized exchanges (CEXs) like Binance or Coinbase, Uniswap operates without intermediaries. It allows users to trade cryptocurrencies directly from their wallets, eliminating the need for a central authority to hold funds or facilitate transactions. This decentralized approach aligns with the core principles of blockchain technology: transparency, security, and autonomy.

Uniswap was created by Hayden Adams, a former mechanical engineer who was inspired by a blog post by Ethereum co-founder Vitalik Buterin. The platform quickly gained traction due to its simplicity, accessibility, and innovative use of automated market-making (AMM) mechanisms.

How Uniswap Works: The AMM Model

At the heart of Uniswap's functionality is the Automated Market Maker (AMM) model. Traditional exchanges rely on order books, where buyers and sellers place orders that are matched by the exchange. Uniswap, however, uses a different approach:

Liquidity Pools: Uniswap replaces order books with liquidity pools. These pools are smart contracts that hold reserves of two tokens in a trading pair (e.g., ETH and USDT). Users, known as liquidity providers (LPs), deposit an equal value of both tokens into the pool.

Constant Product Formula: Uniswap uses a mathematical formula, x * y = k, to determine token prices. Here, x and y represent the quantities of the two tokens in the pool, and k is a constant. When a trade occurs, the formula ensures that the product of the two token quantities remains constant, adjusting the price automatically based on supply and demand.

Fees and Incentives: Every trade on Uniswap incurs a small fee (typically 0.3%), which is distributed to liquidity providers as a reward for their participation. This incentivizes users to contribute to the liquidity pools, ensuring that there is always enough liquidity for trades.

Key Features of Uniswap

Uniswap's success can be attributed to several key features that set it apart from other exchanges:

Decentralization: Uniswap operates entirely on the Ethereum blockchain, meaning it is not controlled by any single entity. This decentralization reduces the risk of censorship, hacking, or mismanagement.

Permissionless Access: Anyone with an Ethereum wallet can use Uniswap to trade tokens or provide liquidity. There are no sign-up requirements or geographic restrictions.

Wide Range of Tokens: Uniswap supports a vast array of ERC-20 tokens, including many that are not listed on centralized exchanges. This has made it a popular platform for trading new and niche tokens.

User-Friendly Interface: Despite its complex underlying technology, Uniswap offers a simple and intuitive interface that makes it easy for both beginners and experienced users to navigate.

Community Governance: Uniswap introduced its native governance token, UNI, in September 2020. UNI holders can vote on proposals to improve the protocol, ensuring that the platform evolves in a decentralized and community-driven manner.

The Impact of Uniswap on DeFi

Uniswap has played a pivotal role in the growth of the DeFi ecosystem. Here are some of the ways it has influenced the space:

Democratizing Finance: Uniswap has made financial services more accessible to people around the world. Users can trade, invest, and earn interest on their assets without relying on traditional financial institutions.

Liquidity Provision: By incentivizing users to provide liquidity, Uniswap has created a robust and efficient market for token trading. This has reduced slippage and improved price stability for many assets.

Innovation in Tokenomics: Uniswap's success has inspired countless other projects to adopt the AMM model and explore new ways to incentivize liquidity provision and community participation.

Challenging Centralized Exchanges: Uniswap has demonstrated that decentralized exchanges can compete with centralized ones in terms of liquidity, user experience, and functionality. This has pushed CEXs to innovate and adopt more decentralized practices.

Empowering Developers: Uniswap's open-source code has enabled developers to build their own decentralized exchanges and DeFi applications, fostering a thriving ecosystem of innovation.

Challenges and Criticisms

Despite its many advantages, Uniswap is not without its challenges:

High Gas Fees: As an Ethereum-based platform, Uniswap is subject to the network's congestion and high gas fees. This can make small trades uneconomical, particularly during periods of high demand.

Impermanent Loss: Liquidity providers face the risk of impermanent loss, which occurs when the price of the tokens in a pool changes significantly. This can result in lower returns compared to simply holding the tokens.

Regulatory Uncertainty: The decentralized nature of Uniswap makes it difficult to regulate, which has raised concerns among policymakers. Increased regulatory scrutiny could pose challenges for the platform in the future.

Competition: The success of Uniswap has led to the emergence of numerous competitors, such as SushiSwap, PancakeSwap, and Balancer. These platforms offer similar features and often provide additional incentives to attract users.

The Future of Uniswap

Uniswap continues to evolve and adapt to the changing landscape of DeFi. Here are some potential developments for the platform:

Layer 2 Scaling Solutions: To address the issue of high gas fees, Uniswap has begun integrating with Layer 2 solutions like Optimism and Arbitrum. These technologies enable faster and cheaper transactions while maintaining the security of the Ethereum mainnet.

Cross-Chain Compatibility: Uniswap may expand its reach by supporting other blockchains, such as Binance Smart Chain or Polygon. This would allow users to trade tokens across different networks, further increasing liquidity and accessibility.

Enhanced Governance: As the Uniswap community grows, governance processes are likely to become more sophisticated. This could include new voting mechanisms, delegation options, and tools for proposing and implementing changes.

New Features and Products: Uniswap is constantly exploring ways to improve its platform. Future updates could include advanced trading tools, improved analytics, and integration with other DeFi protocols.

Mainstream Adoption: As DeFi continues to gain traction, Uniswap could play a key role in bringing decentralized finance to a broader audience. Partnerships with traditional financial institutions and improved user education could help bridge the gap between crypto and mainstream finance.

Conclusion

Uniswap has revolutionized the way people trade and interact with digital assets. By leveraging the power of blockchain technology and decentralized finance, it has created a more open, transparent, and inclusive financial system. While challenges remain, Uniswap's innovative approach and strong community support position it as a leader in the DeFi space. As the platform continues to evolve, it has the potential to reshape the global financial landscape and empower individuals worldwide.

Whether you're a trader, investor, or simply curious about the future of finance, Uniswap offers a glimpse into the possibilities of a decentralized world. Its impact on the crypto industry is undeniable, and its journey is far from over. As the DeFi ecosystem grows, Uniswap will undoubtedly remain at the forefront, driving innovation and transforming the way we think about money.